This blog was written by Irene Leech, an impacted community member on the Mountain Valley Pipeline (MVP) route and Associate Professor of Consumer Studies at Virginia Tech.

For over a century, my family has taken care of farm land in Virginia. I have always seen my role as passing on my farm to the next generation.

But for the past decade, two fracked gas pipeline projects have tried to get in the way of that dream, and the government and financial institutions have backed them. The worst part is that it’s all for a high-risk investment during a climate crisis.

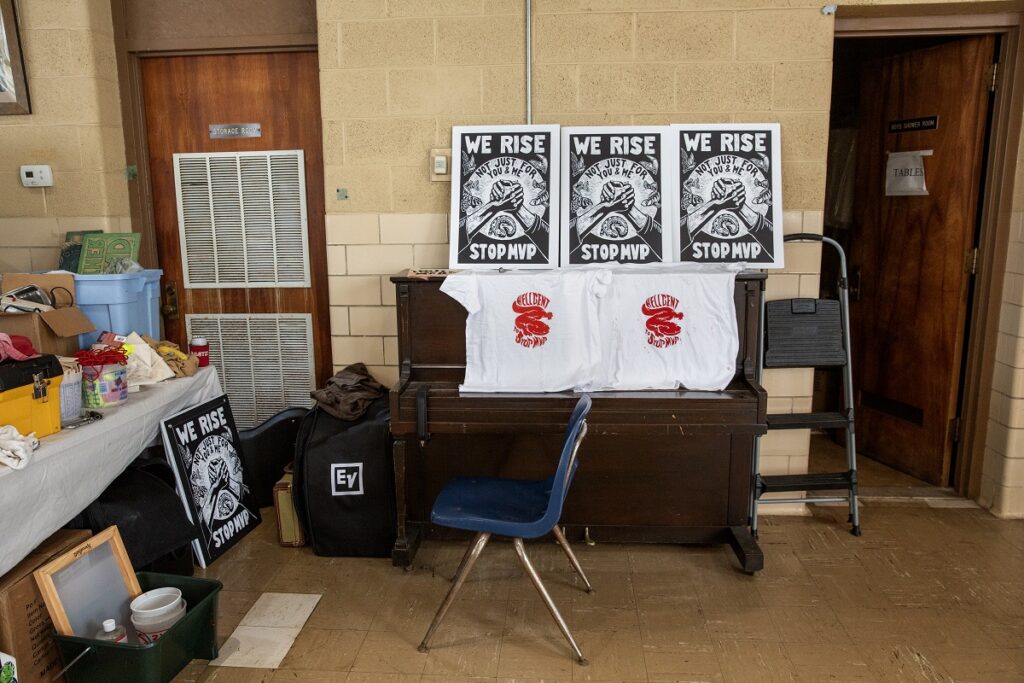

The 600-mile long, 42-inch diameter Atlantic Coast Pipeline cut through my family farm. We made sure it was canceled in 2020. Our small farm near my work is in the evacuation zone of the proposed 303-mile long, 42-inch diameter Mountain Valley Pipeline (MVP). We have fought this project for nearly ten years, but last summer Senator Joe Manchin and Congress greenlit construction.

The MVP was supposed to be completed in 2018, but due to its own recklessness it has faced constant delays and budget increases. And it is still not finished today, in 2024. There is no proven need in the US for the gas pumped by Mountain Valley Pipeline. If the pipeline were to be completed and put into service, the greenhouse gas emissions may be equivalent to 19 million passenger vehicles, or 23 coal plants, and account for at least 1% of all greenhouse gasses from the US energy sector. The MVP is a climate nightmare.

I am an active consumer advocate in Virginia and nationally and I know corporations should not be allowed to be this reckless. Groups like Vanguard are sinking our future by pouring billions into fossil fuels.

The Vanguard Group is the largest single shareholder in EQT, a company propping up the MVP, and has significant leverage with the company. Vanguard is making a huge mistake by tying its investors to this beleaguered project.

Many ordinary people have their money invested with Vanguard. I am nearing retirement and I do not want my hard-earned money to be tied up in stranded fossil fuel assets like the Mountain Valley Pipeline. If Vanguard continues to ignore climate risk, its investors will face diminishing wealth and inability to meet their financial goals. Vanguard is not the safe, steady choice it claims to be.

These pipeline companies have no respect for people nurturing the land for future generations. All they want is immediate profit for themselves. They are fully prepared to leave investors stranded and our environment destroyed. Vanguard must reassess support for fossil fuel projects like the MVP and its Southgate extension, and seriously consider sustainability, environmental justice harms, and climate risks going forward.

As of the end of December 2023, Vanguard has over $16.7B in share holdings and almost $3B in bond holdings in the owner companies of the Mountain Valley Pipeline. On Tuesday, February 20, 2024 MVP stated in a sharings call to Equitrans Midstream that the new projected completion date would be June 2024 making it now 6 years behind schedule and over twice the predicted price.