FOR IMMEDIATE RELEASE

June 16, 2023

Contact: TJ Helmstetter for Vanguard S.O.S. / tjhelm@gmail.com

NEW ANALYSIS: MORNINGSTAR RESEARCH PAPER FINDS BIG GAP BETWEEN ‘BIG THREE’ ASSET MANAGERS ON ESG PROXY VOTING … AND VANGUARD IS AGAIN THE LAGGARD

Morningstar’s New Research Paper Shows BlackRock and State Street Supported Twice As Many ESG Resolutions As Vanguard

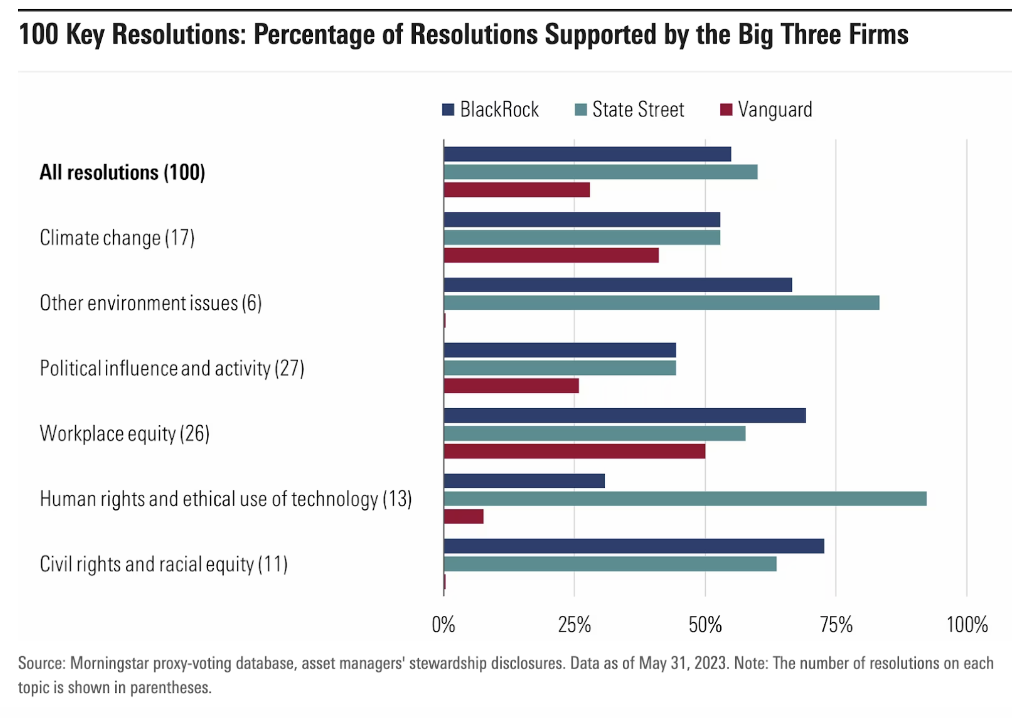

In a new report released earlier this week, Morningstar found that Vanguard’s support for ESG resolutions is half that of its rivals BlackRock and State Street. Morningstar examined 100 “key” resolutions at S&P 100 companies filed over a two-year period ending on March 31, 2023. Morningstar defined a “key” resolution as one that is supported by at least 40% of a company’s independent shareholders. Of course, there are many more resolutions offered each year that do not meet the 40% threshold. The resolutions examined are limited to environmental and social topics, including issues related to climate change and workers rights.

As the chart shows below, Vanguard opposed almost three fourths of the 100 proposals examined. As Morningstar noted in its analysis: “So, investors who prefer to invest with a manager that supports a majority of key ESG resolutions would be more comfortable with BlackRock’s and State Street’s voting decisions than Vanguard’s.”

Morningstar further divided the key resolutions into six topics: climate change; other environment issues (such as water, plastics, and deforestation); political influence and activity; workplace equity; human rights and ethical use of technology; and civil rights and racial equity. Vanguard lagged behind BlackRock and State Street in every single area.

In response to these new findings, climate experts working with the Vanguard S.O.S. campaign issued statements:

“This research confirms what climate advocates have been saying for years: Vanguard is a climate laggard and its failure to adequately assess the material risks of climate change threatens client investments,” said Jessye Waxman, Senior Climate Campaigner at Sierra Club.

“Vanguard’s assets are largely held in passively managed funds, which means proxy voting is a critical strategy to manage risks,” continued Waxman. “If Vanguard refuses to adequately manage risks, it is clearly violating its fiduciary duty. While BlackRock and State Street performed marginally better, they still largely refused to support climate-related resolutions that translated to real-world outcomes. This research should help climate-conscious clients better assess whether their asset manager’s voting choices reflect their values and priorities, and if not, to push for stronger climate-informed proxy voting guidelines.”

“Morningstar’s findings are very much in line with our own Voting Matters report released earlier this year, which found Vanguard to be the worst of a bad bunch,” said Isabelle Monnickendam, senior research officer with ShareAction. “Whichever analysis you turn to, it is clear that Vanguard is voting the wrong way on issues of sustainability. The window for taking decisive action on climate is closing, with extreme weather events linked to global warming already devastating communities and ecosystems around the world causing real damage to our planet.”

“Vanguard has to take responsibility for the negative impacts of its investments and help build a world that is functional and viable for future generations,” added Monnickendam.

About Vanguard S.O.S.

Vanguard S.O.S. is an international campaign pushing Vanguard to chart a new course away from climate catastrophe and toward truly sustainable and responsible investing. The network is made up of civil society organizations, social movements, and financial experts working together to secure a climate-safe future for everyone.